Synergy Credit Union is unhappy with an advisory put out by the Office of the Superintendent of Financial Institutions (OSFI) that restricts the use of the words “bank,” “banker” and “banking” by non-bank financial service providers.

“We are obviously disappointed in this decision. This ruling prohibits the use of everyday common language and puts credit unions at a distinct disadvantage,” says Synergy Credit Union CEO Glenn Stang.

In the cover note for the advisory, OSFI says, “the restrictions apply to all non-bank financial service providers, including both federally regulated trust and loan companies and provincially regulated institutions. They also apply to unregulated financial service providers.”

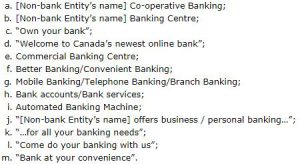

In the advisory OSFI says they view, “the Name Restriction and/or the Business Description Restriction as prohibiting a Non-bank Entity from adopting any of the trade names, or from using any of the phrases, set out below in connection with its business, or any part of its business, in Canada (whether in a logo, slogan, advertisement or otherwise).”

Stang says, “the impact to us is going to be significant because we have all of our advertising and print materials, legal forms, all of our website information, all would need to be changed to take the phrases bank, banker or banking out of it. [Our credit union system nationally], we estimate this could cost us $80 million.”

In a statement, the Canadian Credit Union Association President and CEO Martha Durdin says, “this rule will prevent credit unions from advertising their ‘business banking’ services or even having an ‘on-line banking’ button on a website. Having to create and popularize new words is an unnecessary and expensive undertaking, and will make it difficult for credit unions to compete fairly with banks.”

Stang says, “we’ve been using these terms to describe our business, and use the terms as a verb to describe our business, because the services we provide are very similar to that of a bank but the Office of the Superintendent of Financial Institutions contends that is confusing to the general public.”

He adds, “I would really like the legislators to step back and really take a more common sense approach to this issue and maybe listen a little more to the constituents and is this a really big deal, is this really confusing or not and then maybe go about changing legislation so it’s not so restrictive because this is really everyday common language that Canadians use to describe the kind of business they are doing when they go to a financial institution.”

Stang goes on to say that he thinks the bigger concern for the federal government lies in the new entries into the financial services sector that only provide a small part of what banks or credit unions provide.

“I don’t think our membership or really the general public would appreciate them following through with this, knowing the impact it could have on us,” says Stang.

OSFI expects non-banks to make all necessary adjustments within the following timeline

- Information contained on websites and other electronic mediums-December 31, 2017

- Information contained in print materials-June 30, 2018

- Information contained on physical signage-June 30, 2019.

Stang is urging residents to speak up.

“I’d really encourage the public to let their MP’s know their view on this matter so that they know it’s maybe a bigger deal than what it’s proclaimed to be by OSFI.”