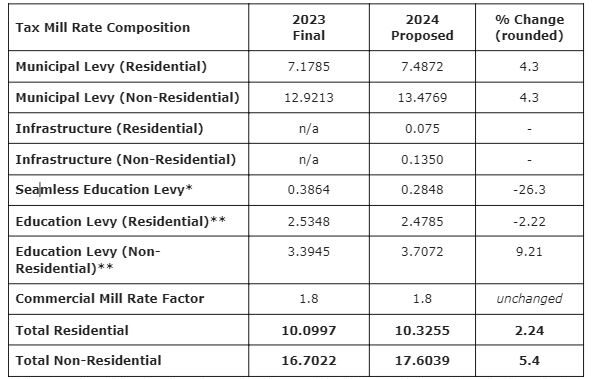

The first reading of the proposed property tax increase is in the books. Lloydminster City councillors will face two more readings of the mill rate bylaw which has a roughly $5.40 per month increase on a residential property valued at $285,000.

Also, the proposal calls for an approximate $56.00 per month increase on non-residential properties valued at $750,000.

The total taxable assessment for the 2024 tax year is $4.82 billion (as of May 2, 2024), up from $4.65 billion the previous year. In 2024, with the assessment and proposed mill rate changes, the tax levy will collect an estimated $46,207,840.

The second and final bylaw readings are scheduled for Monday, May 27.

The proposed changes are detailed below.